Working Papers

[Food Demand] New Estimates of US Markups and Their Reactions to Aggregate Demand. Coauthored with Bulat Gafarov and Jens Hilscher.

Presented at the 2023 SEA and 2024 AEA as well as 2025 CEA annual meetings. You may download this paper at SSRN.

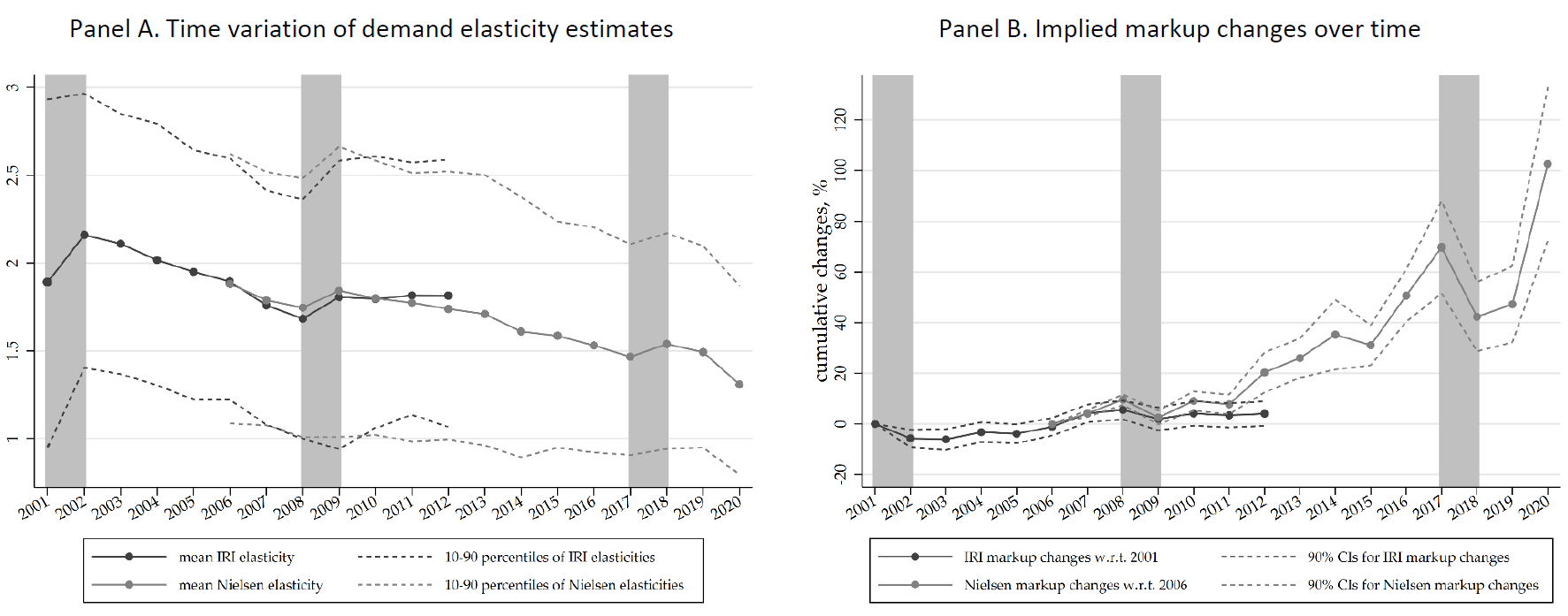

This paper proposes new estimates of US markups and investigates the contributions of aggregate demand and market concentration measures to their dynamics. We proceed in two steps. First, we show that markups can be nonparametrically estimated based on a locally-linear demand model. We apply a revenue-weighted instrumental variable approach to estimate region-specific time-varying markups using US grocery price scanner data from 2001-2022. We find a secular trend rise and unconditional procyclical variation in markups. Second, using a dynamic panel model, we quantify the contributions of four main drivers of conditional variation: demographic trends, market concentration, aggregate demand, and the real interest rate. Taken together, these factors explain a large fraction of markup variation across markets and over time. The variations in demographic and market concentration factors had only small impacts, which moved in opposite directions. From 2008-2016 negative real interest rates increased markups counteracting downward pressure from aggregate demand factors; later in the sample markups increased because of higher aggregate demand. Over our sample period, both overall and food-at-home CPI inflation were similar to markup growth, suggesting that real marginal costs may have declined.

[Agricultural Production] The countervailing investment and rental-supply effects of securing land ownership: Theory and evidence from Nicaragua.

Submitted. Presented at the 2024 SEA and 2025 AEA annual meetings. You may download the paper here.

Securing land ownership has been hypothesized to significantly boost agricultural output and reduce poverty in rural economies with unequal land ownership distributions. This paper demonstrates that non-security barriers to long-term land rental contracts can induce countervailing effects of land ownership security on land-attached investments and land rentals, which may disproportionately diminish the poverty reduction gain at equilibrium. I also provide empirical evidence from Nicaragua, one of the poorest countries in Latin America. Using spatial variation in credit supply shocks from financial and microfinance crises in 2008, I find that participation in land security improvement programs led large landowners in less-affected districts to significantly increase agricultural credit use, expand land-attached investments, and reduce land rentals.

[Social Welfare] The countervailing investment and rental-supply effects of securing land ownership: Welfare implications for rural economies endowed with unequal land ownership distributions.

You may download the early draft here.

Securing land ownership has been hypothesized to yield significant gains in both agricultural output and poverty reduction in Latin American rural areas, where land ownership distributions have been highly unequal. These win-win economic gains largely hinge on the premise that security improvement will simultaneously boost land-attached investments and increase land rental supply to facilitate land access for the rural poor. However, Gong (2024) demonstrates that the investment effect will attenuate the rental-supply effect when non-security barriers to long-term land rental contracts are present. This paper employs a multi-agent simulation approach to investigate the extent to which the associated economic gains may be downsized for a typical unequal rural economy. Numerical results show that relative to the ideal case of no non-security barriers to long-term land rental contracts, after land ownership is fully secured: (i) the operational land under rental may experience a substantially smaller expansion or even a shrinkage; (ii) the wage rate may increase by a significantly smaller percentage accordingly; and (iii) both land-attached investments and agricultural output, however, may only witness a slightly smaller but still sizable increment. These findings indicate that non-security barriers to long-term land rental contracts may disproportionately diminish the welfare benefits of securing land ownership for the rural poor.

Ongoing Projects

Price dynamics of organic versus conventional fresh produce: Market, macroeconomic, and weather factors. Coauthored with Bulat Gafarov and Jens Hilscher.

Presented at the 2025 AAEA annual meeting, to be presented at the SEA annual meeting.

Fresh produce is the largest category of organic food sales in the U.S. This paper studies the relative price dynamics of organic versus conventional produce from 2006 to 2023. Using retail scanner data, we find that the revenue-weighted average price of organic produce declined relative to conventional produce across major grocery markets beginning in 2017, with the exception of a brief uptick following the onset of COVID-19. Prior to 2017, the relative price exhibited substantial fluctuations without a clear trend. Our analyses show that macroeconomic and market factors—real interest rate, housing prices, unemployment, product supply and variety as well as retailer concentration—account for a substantial share of this variation, especially the post-2016 downward trend. In addition, weather conditions in major fruit- and vegetable-producing states—precipitation and temperature—contribute significantly to short-term price fluctuations and place upward pressure on the relative price.